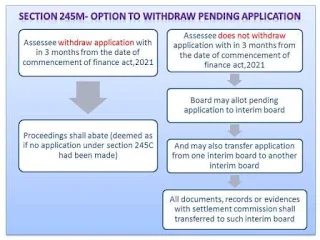

Section 245M of Income Tax Act a new section which is inserted in Finance Act, 2021. This section provides an option to withdraw pending applications which is made under section 245C.

If

an assessee has made application under section 245C then he has the option to

withdraw the same under section 245M within a prescribed period.

In the following, we have explained in detail about section 245M of Income Tax Act’1961:

What is the time limit to withdraw an application under section 245M?

Section

245M provides an option to withdraw pending applications within a period of 3

months from the date of commencement of the Finance Act, 2021.

And

assessee has to intimate about such withdrawal of application to Assessing

officer (in the prescribed manner).

What happens if the application is withdrawn within the time limit?

If

the assessee withdraw his application within time limit (i.e. 3 months from

commencement of the Finance Act, 2021), then proceeding shall stand abate on

the date on which such application withdraws.

In

addition to that authority (Assessing Officer or any other Income Tax Authority

as the case may be) where proceeding related to application was pending, shall

dispose the case as if no application has been made under section 245C.

Also Read: Section 206AB- Higher TDS rate for Non-filers of ITR

What happens

if the application is not withdrawn within the time limit under section 245M?

If

assessee not opts for withdrawing of application with in time limit than:-

- Board may allot pending applications to any interim board by making an order.

- And a board may also by an order transfer that application from one interim board to another interim board.

- In both the above cases whether it allotment or transferred to interim board then pending application shall be deemed to have been received by interim board on date on which application is allotted or transferred.

- In case of allotted pending application to interim board or transfer of pending application to another interim board than all the document, records or evidence with settlement commission shall be transferred to such interim board.

Conclusion

Section 245M of Income Tax Act a new section inserted under Finance Act 2021 which provides provision related to the option to withdraw pending application where assesse has the option to withdraw any pending application within a period of 3 months from the date of commencement of Finance Act, 2021.

Also Read: E-Invoicing under GST (Applicability from 1st April, 2021)

Post a Comment

If you have any query, Please let us know.